Build vs. Buy vs. Partner in the Age of AI, and How Your CFO Can Help

JP's Profitable Growth - Vol 09

Hi (👋 ), welcome back to a new edition of Profitable Growth, an operator's newsletter for operators, at the cross-section of AI, operational excellence and strategic finance.

The concept was made popular by John Chambers, the former CEO of Cisco, who delivered an astonishing 3,800% revenue growth during his tenure, but it is often forgotten or underutilized by business leaders. It may now take a new life thanks to AI.

Most tech businesses were started by building an MVP, so the natural progression from there is to continue to build as the company grows and investors are putting money in for you to build even more and deepen your moat. Makes total sense. But you may reach a point where there are faster and more cost-effective ways to scale your business than just building it all in-house. This does not only apply to the company product by the way, it’s applicable to all functions across the business.

Let me walk you through a simple but real example from one of the startups I was part of:

The company website had been developed in-house, and the marketing team basically depended on already limited engineering resources to make changes to their copies and creative assets. To make matters worse, the original developer who created the website had left the company. Needless to say, that did not scale 🙂 We made the decision to switch from a Build to a Buy strategy and migrated to Webflow. That put the Marketing team in the driver seat and unlocked their ability to be agile and drive more leads for the business. It also freed up engineering resources that could then be reallocated towards higher value deliverables on our roadmap.

Assessments and decisions like this should happen regularly as businesses scale, and your Finance Business Partner is best suited to help teams understand the financial trade-offs and ROI. In the case above, we understood that there would be temporary overage for hosting two websites during the build and migration phase, but the ROI was clear.

I also think that the pace of innovation in AI is shifting and accelerating how leaders should weight such options.

🧐 What do we mean buy Build vs. Buy vs. Partner?

➡️ Build

When you’re choosing to develop new capabilities entirely in-house, from ideation to development, deployment and on-going maintenance.

Pros:

Complete control over strategic direction, short-term and long-term.

Strengthens business resilience by building internal capabilities and expertise, fostering a culture of innovation.

Flexibility to adapt and pivot rapidly as market and company priorities evolve, without external constraints or dependencies.

Enhanced security and confidentiality of proprietary technologies, processes and data.

Cons:

Usually requires higher upfront investment in infrastructure, headcount, and training, often leading to extended development cycles and delayed market entry.

Significant ongoing commitment to maintaining and updating technology, which can divert resources from other critical strategic initiatives.

Potential challenges in talent acquisition, retention, and motivation, particularly in competitive labor markets, increasing operational risks related to talent gaps.

Risks of internal inefficiencies, siloed decision-making, and limited external market perspective potentially hindering optimal solution development.

How is AI impacting this investment strategy?

On one hand, agentic AI is starting to lower the costs and delivery timelines of projects. Developers who are embracing AI are able to ship a lot more code and with higher quality, making a fully owned tech less onerous. On the other hand, because AI is making it easier to build, it doesn’t mean that you’re building a moat, if it’s easier for competitors to do the same. I always advise that developers be focusing their efforts on what the company has identified as core IP and ruthlessly deprioritize or reassign what is not.

➡️ Buy

When you acquire external companies or license specific technologies to rapidly integrate pre-existing capabilities, accelerating strategic initiatives without the extended timelines of internal development.

Pros:

Immediate integration of proven technologies and established market solutions, significantly reducing the time to market compared to internal development.

Rapid expansion of market share and capabilities, particularly valuable in highly competitive or fast-moving markets where speed and agility are critical.

Acquihires to get quick access to talent and operational expertise that might otherwise take significant time and resources to develop internally.

Provides competitive advantages by strengthening market positioning through integrating complementary technologies and customer bases.

Cons:

High initial capital outlay, including possible acquisition premiums, legal fees, and integration costs.

Integrations are hard, posing significant risk and potentially disruptive to ongoing operations.

Potential for cultural clashes, employee turnover, and morale issues due to the challenges inherent in merging different organizational identities and management styles.

Sometimes 1+1 ≤ 2, not 3, leading to diminished returns and increased operational complexity if integration is poorly executed.

How is AI impacting this investment strategy?

The rapid advancements in agentic AI are rapidly lowering barriers of entry for competitors across all industries. Companies will need to be super crisp on their core IP and defend it through accelerated innovation. For what is not core IP, you may get a better ROI and time-to-market by licensing the technology. When targeting a company for acquisition, however, valuation multiples for AI startups are at record levels. As such, mostly deep pocketed and larger companies have been able to afford such acquisitions.

➡️ Partner

When you establish strategic collaborations or alliances with third parties, leveraging mutual strengths without requiring full ownership or extensive resource allocation.

Pros:

Quick access to advanced capabilities, technologies, and established market positions without substantial upfront investment, enabling rapid strategic expansion.

Reduced financial and operational risk through shared investments, responsibilities, and mutual accountability, allowing flexible responses to market changes.

Provides opportunities for experiential learning, innovation, and knowledge transfer, enhancing internal competencies without major capital commitment.

Facilitates scalability and agility, enabling companies to pilot new technologies and market segments rapidly, validating strategic assumptions before deeper investments.

Cons:

Limited direct control over strategic direction, product development, and quality assurance, potentially resulting in misaligned expectations or compromised outcomes.

Increased vulnerability due to dependency on partner performance, reliability, and strategic priorities, creating risks if partners pivot or underperform.

Intellectual property risks, including potential exposure or loss of sensitive proprietary information shared within partnerships.

Potentially complex and resource-intensive partnership management, including governance structures, contract negotiation, and ongoing performance monitoring, requiring sustained attention and resources to maintain successful collaborations.

How is AI impacting this investment strategy?

While new, MCP and A2A frameworks are making it easier to integrate with other AI providers and leverage their capabilities. This is a area to watch for learnings from early success and setback use cases. More to come in future posts.

📶 How do these materialize in the real world?

Below are a few public cases from industry leaders to illustrate who each strategic decision can play out in complex business environments:

Build: Stripe’s Infrastructure Investment

Stripe’s strategic choice to build its payment infrastructure internally was instrumental in its global success. By opting for internal development, Stripe ensured maximum flexibility, customization, and operational control over its critical payment processing systems. This internal build strategy allowed Stripe to uniquely cater to the specific needs of developers and enterprises, rapidly iterating on features tailored to its target market. The investment in proprietary infrastructure also provided Stripe with unmatched reliability and scalability, directly contributing to its market dominance and consistent growth in transaction volumes and client base.

Buy: Snowflake’s Acquisition of Crunchy Data

Snowflake’s recent strategic acquisition of Crunchy Data was a significant turning point, greatly enhancing its capabilities in AI-driven database management. Recognizing the urgent need for advanced, AI-ready data platforms, Snowflake swiftly acquired Crunchy Data to leverage its expertise in PostgreSQL database solutions. This acquisition immediately boosted Snowflake’s technical capabilities, accelerated market entry, and significantly improved competitive positioning. Snowflake’s proactive buy strategy allowed it to integrate proven technologies, leverage Crunchy Data’s established client relationships, and rapidly scale operations, demonstrating the strategic effectiveness of acquisitions in swiftly evolving tech landscapes.

Partner: Slack’s Growth through Strategic Alliances

Slack’s meteoric rise can largely be attributed to its strategic approach of forming alliances with widely used software platforms such as Google Drive, Trello, GitHub, and Salesforce. Instead of building extensive functionalities in-house, Slack prioritized integration capabilities, significantly accelerating user adoption. These integrations not only broadened Slack’s appeal but also allowed it to rapidly scale its market presence and user base. Slack’s emphasis on partnerships minimized initial capital investments and technical risks, positioning it as a powerful and indispensable collaboration tool in the enterprise communication market.

🚀 A Step-by-Step Guide for Practical Decision-Making

Note that this framework should only really be used for sizable investments and when the answer is not obvious.

1️⃣ Frame the Decision in One Sentence

“We need [capability] by [when] to unlock [growth / savings / risk-reduction].”

Locking the objective first keeps later scoring anchored to outcomes, not preferences.

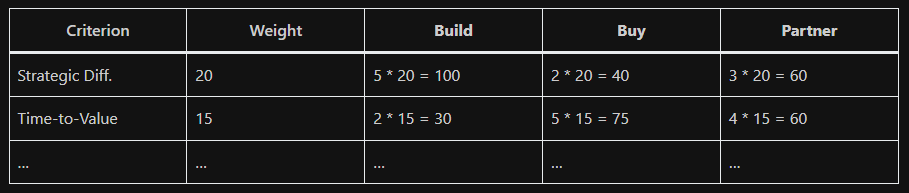

2️⃣ Assign Strategic + Financial Weights (100 pts total)

Tip: Make weights editable—different initiatives may shift emphasis (e.g., regulated FinTech raises Control to 20 pts).

3️⃣ Score Each Option (0–5) Against Every Criterion

Multiply score × weight to get a weighted subtotal.

Example:

Add subtotals; the highest total suggests the front-runner but go/no-go still gets a qualitative sanity check.

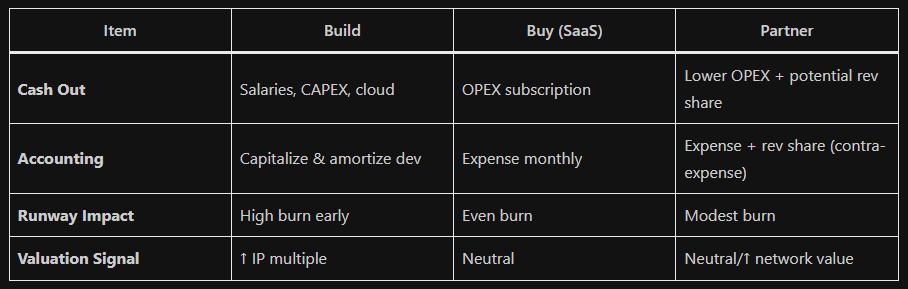

4️⃣ Run the Financial Drill-Down

Model three scenarios (base, upside, downside) over 3–5 years to expose hidden landmines—e.g., renewal price-uplifts beating self-hosting costs by Y3.

👍 Quick Rules of Thumb for Tech Startups

🤖 Leveraging AI for Enhanced Decision-Making

This space is evolving quickly, but modern CFOs can already significantly amplify their strategic decision-making capabilities through practical AI-driven tools and methods, including:

Advanced Scenario Planning: Utilizing AI-driven predictive analytics tools (such as Pigment) to perform sophisticated scenario modeling. This helps CFOs anticipate financial outcomes under varying market conditions and strategic scenarios, reducing uncertainty.

Dynamic Forecasting: Employing real-time AI forecasting tools like Planful Predict, DataRails Predict or Float to continuously update financial and operational forecasts. These tools leverage historical and real-time data to provide highly accurate and timely financial insights.

Resource Optimization Algorithms: AI algorithms, such as optimization tools provided by platforms like Mosaic or mondayAI, can dynamically reallocate resources across projects, departments, and strategic initiatives, ensuring maximum efficiency and alignment with strategic goals.

Enhanced Due Diligence: AI-driven analytics can swiftly evaluate target companies in acquisition scenarios, assessing factors like market positioning, financial stability, technology compatibility, and operational alignment, greatly reducing the time and risk associated with due diligence processes.

AI-Enhanced Risk Assessment: AI solutions like UpGuard or Vouch enable CFOs to proactively identify and manage potential risks, offering advanced insights into market volatility, regulatory compliance issues, and operational vulnerabilities.

Question: Do you have any other emerging technologies you would recommend?

♟️ Final Thought

The best frameworks turn debates into numbers without letting numbers replace judgment. By pairing weighted scoring with runway-aware financial modeling and explicit kill-criteria, CFOs give startups the discipline of an enterprise while preserving the agility that wins markets.