How to make decisions with limited data?

Profitable Growth - Vol 02

Hi (👋 ), welcome back to a new edition of Profitable Growth, an operator's newsletter for operators, at the cross-section of emerging technologies, operating culture and financial discipline.

In this week's edition (est. 5 min. read):

Main Article

Quick Hits

Number to Know

How to make decisions with limited data?

80% of organizations struggle with decision-making, mainly with the speed and the quality of those decisions.

There are already a lot of great advice and frameworks on WHO should make decisions, like Guru's SPADE, McKinsey's DARE, or even Eric Pliner's 4Vs, but what about HOW to make decisions when you only have partial or insufficient information?

It is a more likely scenario in a startup environment where you're breaking new ground daily. In this week's edition, I'm sharing a few suggestions to help you navigate such situations.

1️⃣ Prioritize the decisions you have to make

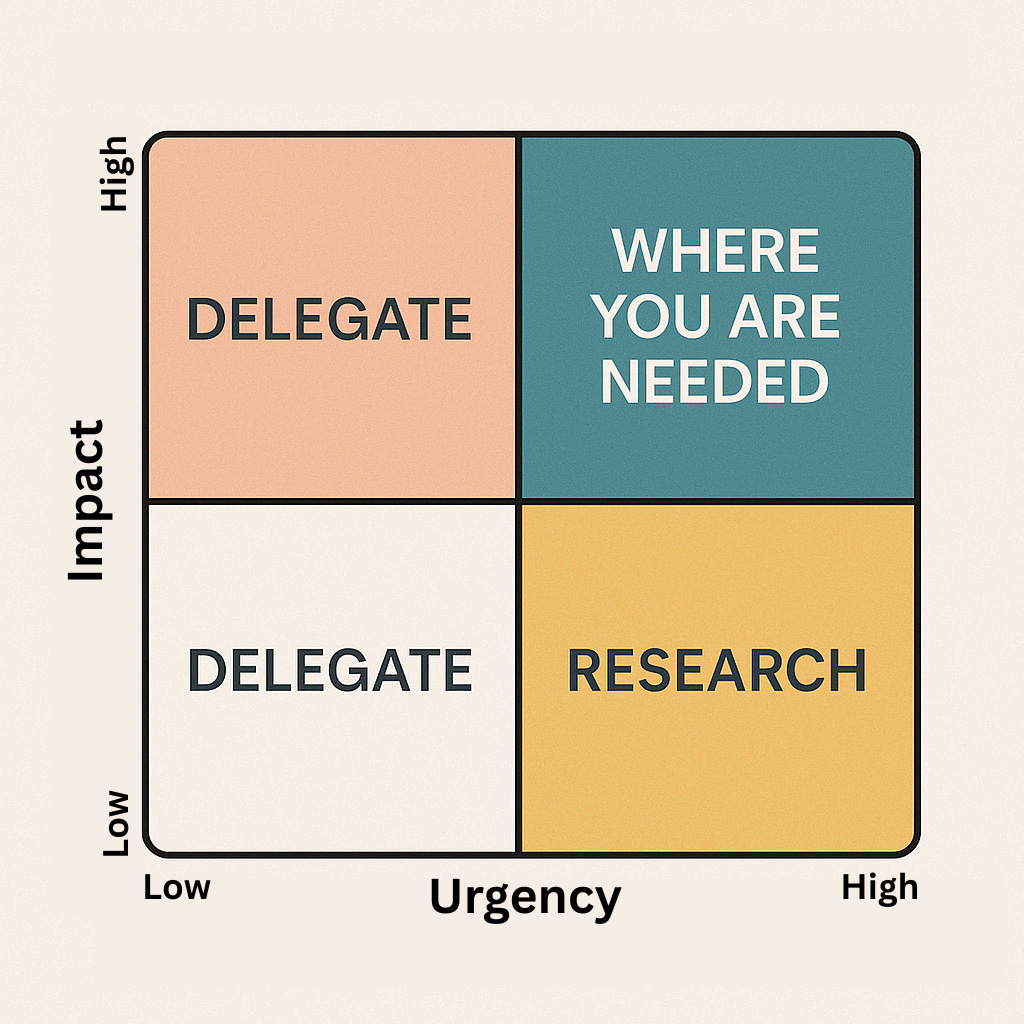

To help me with this, I use a simple mental 2x2 prioritization matrix, inspired by Eisenhower's own, to quickly assess in which bucket the decision coming to you is falling.

The first column speaks to the magnitude of the decision's impact on the business.

If the decision's impact is low, you should delegate. Who is the DRI (directly responsible individual)? Do you trust them to make the right call? If not, why should they still be on your team?

The second column speaks to the urgency of the decision. When the decision is urgent and essential, you are most needed in the top right quadrant.

Needless to say, you and your team need to strive to make decisions without the pressure of urgency. That's the bottom right quadrant, and that's where you’d prefer to be.

It is important to know if the lack of data is a result of urgency, i.e., if the team didn't have time to research. Unless there is an impending deadline, the decision should be postponed until proper research is done.

Now that you are solely focused on the decisions you are truly required to make, what options do you have?

2️⃣ Leverage your experience and intuition

Have you been in a similar situation before? Were the conditions somewhat familiar? What did you or someone else do?

Combined with that experience, what are your guts telling you?

What would you have to believe to be true to choose one option over another? Are your assumptions reasonable?

3️⃣ Value qualitative feedback

A school of thought advocates that data is always there, not just in the form you initially sought. You have ways to get signals through alternative data sources to inform your decision through inference. Consider the following example:

Situation: your startup is trying to expand into a new market, but it's a smaller market, and there isn't enough market research data available.

AI Application: Using AI, you can analyze unstructured data sources like social media, online forums, and news articles to gauge consumer sentiment and the needs of a market.

Outcome: this approach can support your decision-making process without the need for extensive traditional market research.

4️⃣ Grab the phone

Ask professional peers and mentors if they have been in a similar situation before and what their approach/learnings were. If they have not, what would they consider in your situation, knowing you're lacking data?

5️⃣ Be inclusive

While you want to avoid the trap of the democratic vote, what does your team think? What do they recommend and why? Are they ready to commit?

6️⃣ Do the right thing

Does the decision you're leaning toward align with the company's core values, mission, and vision statements?

Sometimes, making the right decision means taking one small step backward to make two steps forward.

Core values and compliance are foundational elements in building a culture of accountability. By fostering a work environment where ethical conduct is prioritized, you cultivate trust and integrity across the organization.

7️⃣ Make the decision

Personally, the more of the above boxes I check when making a critical decision with limited data, the more comfortable I am with it, even in the face of uncertainty.

No decision, or delaying the decision, can also lead to disaster. Avoiding decisions is not the way to avoid the consequences. As a leader, your teams count on you to make the tough calls, and you must own them.

But it doesn't stop there

Perhaps as important as making that difficult decision is what you do after you've made it:

Years ago, a brilliant colleague said something that resonated and stuck with me:

"You lay a brick"

If you were missing data, are you now instrumenting to ensure it doesn't happen again?

Remain flexible and ready to adapt your strategy as new information emerges. Allowing room for tweaks makes taking calculated risks easier.

Keeping a positive outlook and fostering continuous learning within your organization supports resilience.

A few parting thoughts…

Get used to it. It's going to happen again.

Develop your own decision-making framework to help you analyze options efficiently. Your framework should be closely tied to your business model and company values.

What do you think? What has been your experience? Anything you would do differently?

Quick Hits: What's On My Radar

Article/Video: a glimpse into the future when AI agents will use their own language to communicate more efficiently in real life scenarios. Have you been in a situation when two people start speaking in a foreign language and you’re standing there without a clue of what they’re saying? Watching the staged demo felt like that. 😳 For more context, this feat came out of a recent Eleven Labs hackathon -- fascinating!

Trend: Wikipedia raised awareness on an emerging trend that should be underestimated: 65% of their most expensive traffic now comes from AI scraping. Your business is likely impacted as well. It’s not just hosting but also advertising costs.

New AI model: Open AI just released GPT-4.1 in their API. The cost of “older” models has been lowered - more arbitrage opportunities!

Number to Know

10 Months

That’s the median duration of recessions in the US since World War II, from peak to trough. The shortest was the 2020 COVID-19 recession, which lasted just two months. The longest was the Great Recession (subprime crisis) and lasted 18 months. It’s another data pointing influencing the cash runway startups should aim to maintain in uncertain times: 12-24 months.

That’s it for this week, short and sweet! Hope you found this content helpful.

If you wouldn’t mind sharing your feedback here, that would be great! 🙏

Until next Tuesday, 👋

JP

Great article! I also want to point out that in some organizations, executive team leaders may hesitate to champion innovative ideas or share their opinions due to fear of blame in case of failure. Fostering a culture that tolerates "failures", and reward courage instead of tracking mistakes, is crucial to encourage open dialogue and harness diverse perspectives. Additionally, in startup environments, board members and/or investors can be invaluable sources of insights and feedback when exploring blue ocean strategies. Their prior research and experience in various markets can provide guidance, help validate new opportunities and enhance strategic decision-making.