When Growth Follows Fit: Aligning Metrics, Roadmaps, and Cross-Functional Feedback

JP's Profitable Growth - Vol 08

Hi (👋 ), welcome back to a new edition of Profitable Growth, an operator's newsletter for operators, at the cross-section of AI, operational excellence and strategic finance.

In this week's edition (est. 5 min. read):

Main Article

Quick Hits

Number to Know

Whether it’s your first product or your next ones, knowing where you stand on your product-market fit (PMF) journey is essential to making the right investment decisions.

In this edition, I share strategies for achieving and maintaining PMF, leveraging quantitative and qualitative metrics, scalable acquisition strategies, and maintaining operational excellence. I’ll organize the content across the five most frequent questions I came across when scaling startups.

🧐 What metrics should be prioritized to objectively assess PMF?

Contrary to popular belief, having PMF is rarely binary. You are on a journey where you reach a certain degree of “fit”. Markets are dynamic and that fit could be lost after some time, and regained again later. So, I’ve found that establishing a measurement process to objectively assess PMF allows you to stay ahead of the curve. It’s a balance of quantitative and qualitative metrics. Here are a few examples:

1️⃣ Starting with my favorite: Customer Retention Rate. That’s a key early indicator that shows that customers find ongoing value, signaling that the product does solve a meaningful problem. Expand that to a Net Revenue Retention (NRR) above 100%, then you have a clear signal.

2️⃣ Followed by my second favorite: Net Promoter Score (NPS). This metric measures your customers’ willingness to recommend your product, which is a reflection of customer satisfaction and market reception.

3️⃣ Growth Rate (both in terms of users and revenue). Strong consistent growth in active users and sales demonstrates that there is market demand and scaling potential.

4️⃣ Customer Lifetime Value to Customer Acquisition Cost, or LTV:CAC. An improving ratio, combined with consistent conversion rates, demonstrates efficient growth and sustainable unit economics, confirming that there is a viable desire for the product.

5️⃣ Direct customer feedback about the value and usability of your product can provide deeper context behind your quantitative data.

6️⃣ Competitors changing strategies or features in response to your product indicates it is impacting the market landscape.

Question: What else would you look at?🧭 How to benchmark customer satisfaction against industry standards to confirm PMF?

I would start with the American Customer Satisfaction Index (ACSI), a great resource providing access to valuable insights trends.

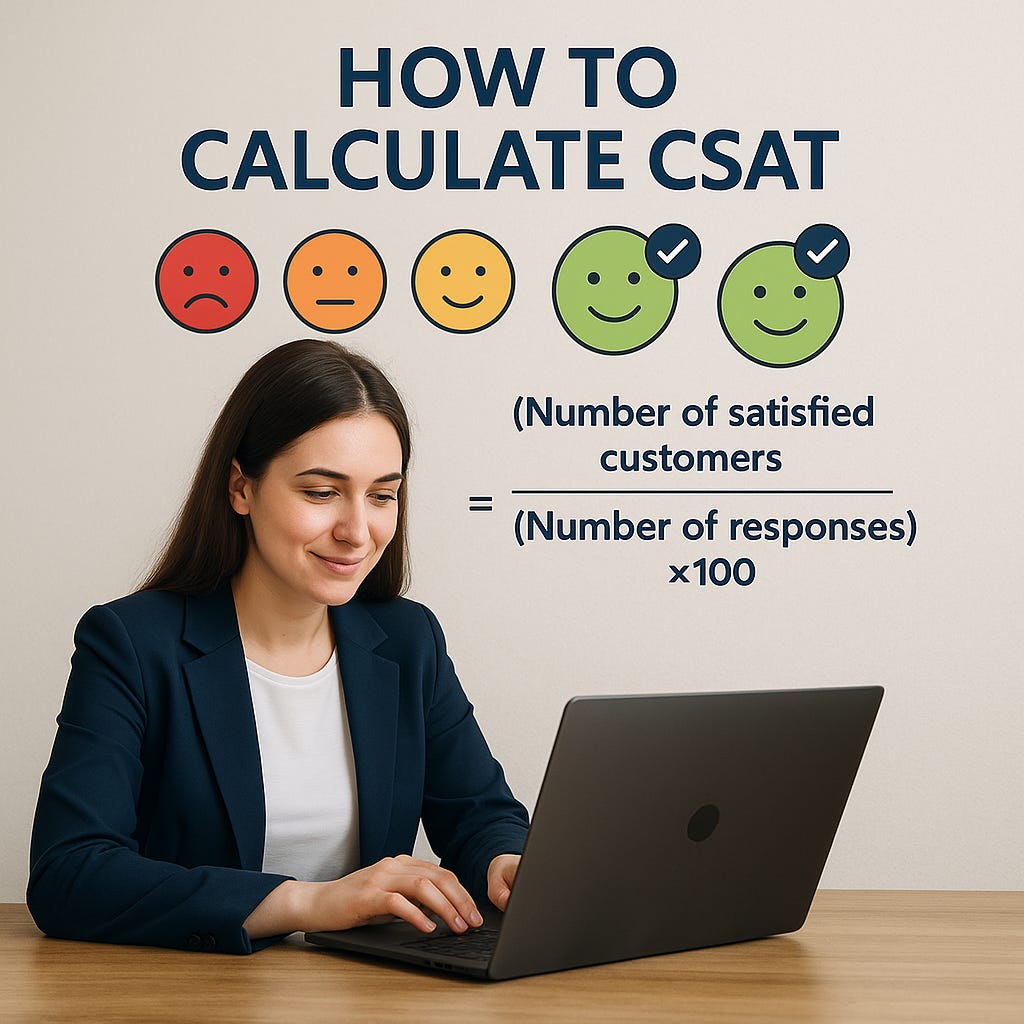

How is customer satisfaction (CSAT) calculated?

Broadly speaking, a CSAT score above 80% is generally considered excellent, while scores between 60% and 80% indicate room for improvement. Scores above 50% are typically seen as decent, with anything around 60% to 70% being fairly common for many industries. For instance, a 2022 study from Klaus reported that B2B tech companies with less than 1,000 employees had an average CSAT of 89%.

Perhaps as important as the score you’re currently at, is it improving?Strategic Value and Risks

Market Positioning: Benchmarking helps companies understand their market position relative to competitors, enabling them to make informed decisions about product improvements and investments.

Resource Allocation: By identifying areas where customer satisfaction is lagging, companies can allocate resources more effectively to address these gaps, which can lead to increased customer loyalty and profitability.

Investor Confidence: Demonstrating strong customer satisfaction can enhance investor confidence, as it indicates a company’s ability to generate revenue and sustain growth.

💖 How to interpret referrals or word-of-mouth in the context of PMF validation?

Strong referral rates or word-of-mouth are among the most reliable qualitative signals of PMF. When a growing number of users actively recommend a product to peers, it demonstrates that the product is not only satisfying needs but also compelling enough to trigger advocacy. That’s a leading indicator, ahead of metrics like revenue or retention.

But you can take it further using Sean Ellis’ PMF Survey, which basically asks users “How would you feel if you could no longer use [ProductName]?” If a large portion (Ellis suggests at least 40%) say “very disappointed,” it signals strong PMF.

Slack is a great example of how word-of-mouth drove early adoption and rapid organic growth. Referral-driven growth lowers CAC and increases scalability of go-to-market strategies. Reducing reliance on paid channels and increasing organic adoption is critical for tech startups to achieve escape velocity.

For unlocking additional growth velocity, engage with the “very disappointed” users to deepen your understanding of product value and create new opportunities. So much more can be unlocked by understanding not only what’s working but also understanding what is not.

🎢 How to continuously evolve the product and value proposition to sustain PMF in a dynamic market?

Markets are dynamic and PMF should not be taken for granted. New entrants, moves by competitors or simply customer behaviors could change that. Product strategies must be fluid, evolving alongside company vision, market demands, and customer needs. Early-stage startups should prioritize discovery, growth-stage companies focus on scalability, and mature-stage organizations optimize for sustainability and relevance.

A product roadmap is not just a feature backlog but a strategic tool that aligns teams, prioritizes high-impact initiatives, and ensures resources are focused on what matters most. It should be based on user research, business objectives, market trends, and technical feasibility. It should be continuously updated to reflect changing priorities.

To operationalize this, you need a framework. Here’s a simple one: “impact vs. effort” and “strategic alignment” to ruthlessly prioritize those features. This ensures resources are allocated to initiatives that drive the most customer value and business growth, avoiding the trap of overloading the roadmap with every possible request.

🚀 How to structure cross-functional feedback loops to refine PMF?

Reaching and sustaining PMF requires cross-functional collaboration across the entire organization, as it not only directly correlates with the value delivered and perceived by customers across sales, onboarding, customer success and product, but also with how efficiently that value is being delivered in conjunction with operations and finance teams.

➡️ To establish the right feedback loops:

Combine the above-mentioned metrics with detailed usage reports to align and focus your teams on improving them.

By aggregating customer feedback from surveys, interviews and social media, you can get a comprehensive view of the product’s reception. By also integrating feedback from finance (e.g., ROI analyses), operations (efficiency metrics), and customer success (customer retention) you can get an even more holistic view of product performance.

Publish and share reports regularly across the company. Involving finance, operations, and customer success in this process ensures alignment and support for product development decisions.

➡️ Turbocharge cross-functional collaboration by:

Communicate back to stakeholders (including finance, operations, and customer success teams) how their feedback has been incorporated. This transparency builds trust and encourages further engagement, ensuring that feedback is continuously used to refine product-market fit metrics.

Communicating back to stakeholders (including finance, operations, and customer success teams) on how their feedback has been incorporated. This transparency builds trust and encourages further engagement, ensuring that feedback is continuously used to refine product-market fit metrics.

♟️ Final Thought

Tracking everything in cohorts to see further confirmation that you’re headed in the right direction. Is each cohort curvature healthier than the previous one? Regardless of the answer, understanding why will help accelerate your journey towards a strong PMF.

Quick Hits: What's On My Radar

A growing number of companies face significant hurdles with AI “hallucinations” with AI developers citing it as a top challenge.

Prioritizing the right AI use case remains for a significant number of business (40%+ according to Glide)

Number to Know

50%

That’s the percentage of entry-level white-collar jobs that AI could eliminate within five years, according to Anthropic’s CEO. He’s urging governments and companies to prepare for significant disruption.

We’ve already seeing some of the largest companies announcing significant rounds of layoffs. While there is correlation with those companies’ adoption of AI, not all have explicitly acknowledged causation.

Some companies have already started investing in upskilling their workforce in AI as developing more complex AI workflows still require human involvement.

Until next week, 👋

JP